Lending

In 2020, the data on lending showed an advance in non-government credit by 5.5% to 282 billion lei (€58 billion), contemplating the fact that the economy shrank by 3.9%. Last year, in Romania, the real GDP decline was a modest 3.9%, less severe than the EU decline of -6.1%.

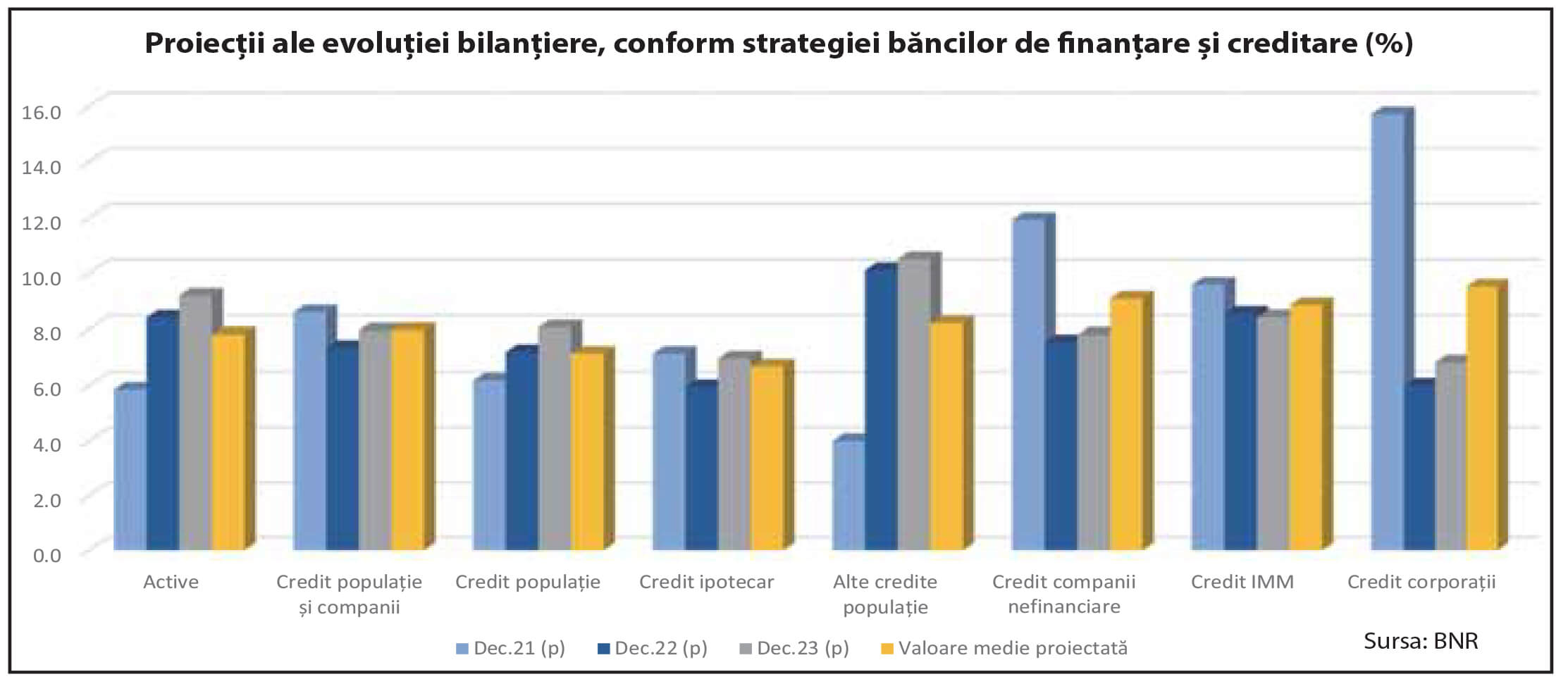

At the end of 2020, financial intermediation advanced to 26.8% while in the countries in the region this level was significantly higher: in Hungary (35%), even double in Poland (48%), Bulgaria (52%) or the Czech Republic (54%), while the European average of this indicator stood at 92%. Financial intermediation returned to growth, after having dropped from 40% in 2011 and we do hope that this upward trend will continue. Credit institutions take into account an increase in non-government credit of 8% during December 2020 – December 2022. In conformity with their strategies, lending is to accelerate mainly for the non-financial companies segment. These companies still have vulnerabilities related particularly to the large number of firms with own funds below the regulated limit and to a lax payment discipline. In 2020 and in the first half of 2021, the banks operating in Romania granted new loans at a brisk pace, just like in normal times, for that matter. In the context of the pandemic, banks continued to gain momentum in lending, covering their customers’ financing needs, the new loans granted to the non-government sector being slightly higher in volume last year compared to the year 2019.

Last year, the new loans granted to corporations and to households stood at 84 billion lei and had a weight of almost one third of the non-government credit balance. The 84 billion lei represent new money entering the economy, money via which banks have been supporting company development/the ongoing concern or the purchases of residential homes and durables which support the economy. In 2020, the new loans entering the economy had a weight of 8% of the GDP during merely one year.

The new loans granted by the banks operating in Romania to households and to corporations went up by 32% in the first four months of 2021, despite the context of the pandemic, to 34 billion lei, compared 66 to the same period of 2020 (when the loans granted amounted to 25.7 billion lei). Thus, the volume of the new loans granted during these four months is higher by one third compared to last year’s figure and represents over 11% of the non-government credit balance. The non-government credit balance is calculated as the difference between the total loans granted to households and to corporations and the total and partial reimbursements plus loan sales.

In the first four months of this year, the new lending was boosted particularly by the new money granted to corporations which represents a weight of 56% of the volume of new bank loans. The upward trend in lending continued in July as well, the non-government credit advance standing at 12.6%, at an annualised pace, up to 306 billion lei, actually the highest lending growth rate since the start of the pandemic. Currently, when it comes to households, mortgage loans are the ones which boost lending, their growth standing at 20% in Q1 2021 compared to the similar period last year.The “Prima Casă” (First Home) programme represents 18% of the new mortgage loans granted to households in the last 12 months and 39% of the stock of total mortgage loans (March 2020), mentions the National Bank of Romania (NBR)’s data.

For households and for corporations alike, lending was facilitated by the measures intended to smooth out the loan granting process and by the guarantees granted, following the decisions taken by the state and by banks. We will continue relying on the acceleration of corporate lending, one of the programmes which gives momentum to corporate lending being the one called IMM INVEST. The loans granted under the IMM Invest programme amounted to 16.8 billion lei at the end of last year and represent 13% of the current stock of loans granted to non-financial companies. For companies, this programme had a bank ability level of 1 out of 3, better than the general one of 1 out of 7. In fact, lately, corporations’ increasing lending appetite has been constant. During the last five years, the demand for corporate loans has given momentum to lending in the Romanian banking sector. During these five years, households were granted 44.45% of the volume of new loans while corporations contracted loans amounting to 55.55%. We estimate that the alert upward trend of corporate lending will go on. The partial renewal of the loan portfolio can be explained by the high weight of short-maturity corporate loans. During 2016-2020, banks in Romania granted new loans to households and to corporations amounting to 388 billion lei, by 37.5% more compared to the non-government credit balance at the end of last year. So, during those fi ve years, the new loans portfolio exceeded the non-government credit balance by one third. The distribution by currency shows much interest for the new loans denominated in the domestic currency – namely, 80% of the loans granted during 2016-2020 were denominated in lei while 17.1% were denominated in euros and 2.5% in dollars. Households applied for loans denominated mostly in lei, 98% of their total being denominated in the domestic currency, a fact which led to the elimination of the foreign exchange risk. Corporations were granted loans denominated in lei amounting to 66.13% of the total, the rest being loans denominated in foreign currency. The euro-denominated new loans were requested mainly by corporations (95.24%) while a mere 4.76% went to households, with the dollar denominated new loans contracted almost entirely by corporations.

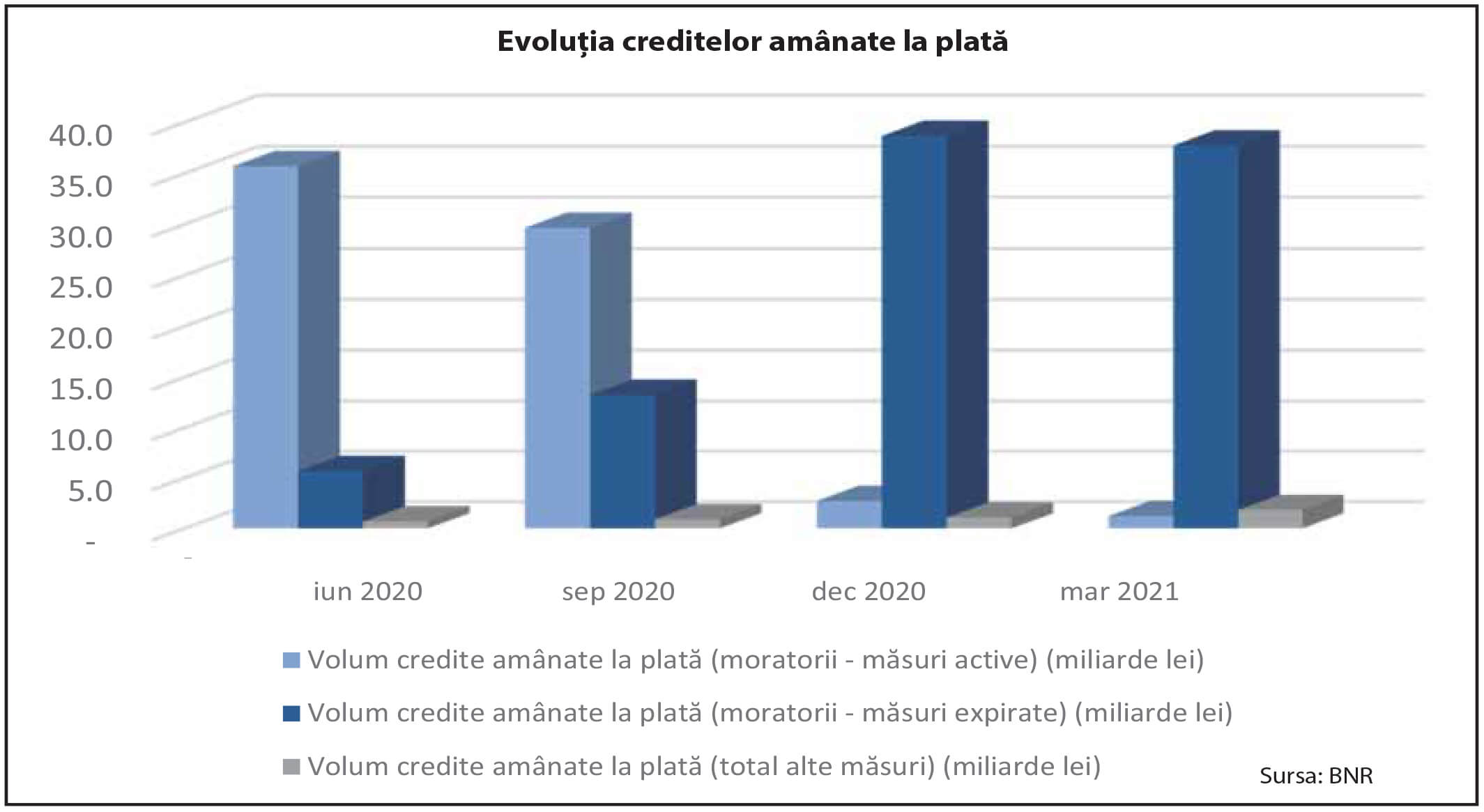

The banks operating in Romania have been supporting their customers and the authorities when it comes to limiting the negative effects on individual economic welfare, on Romania’s economy and on public health and safety, in the context of the new coronavirus pandemic. Thus, credit institutions have supported their debtors who were in financial distress because of the pandemic, by suspending their payment obligations. At the end of March 2021, the weight of the loans benefiting from the effects of the public and private moratoria stood at 12.7% of total loans, according to the information

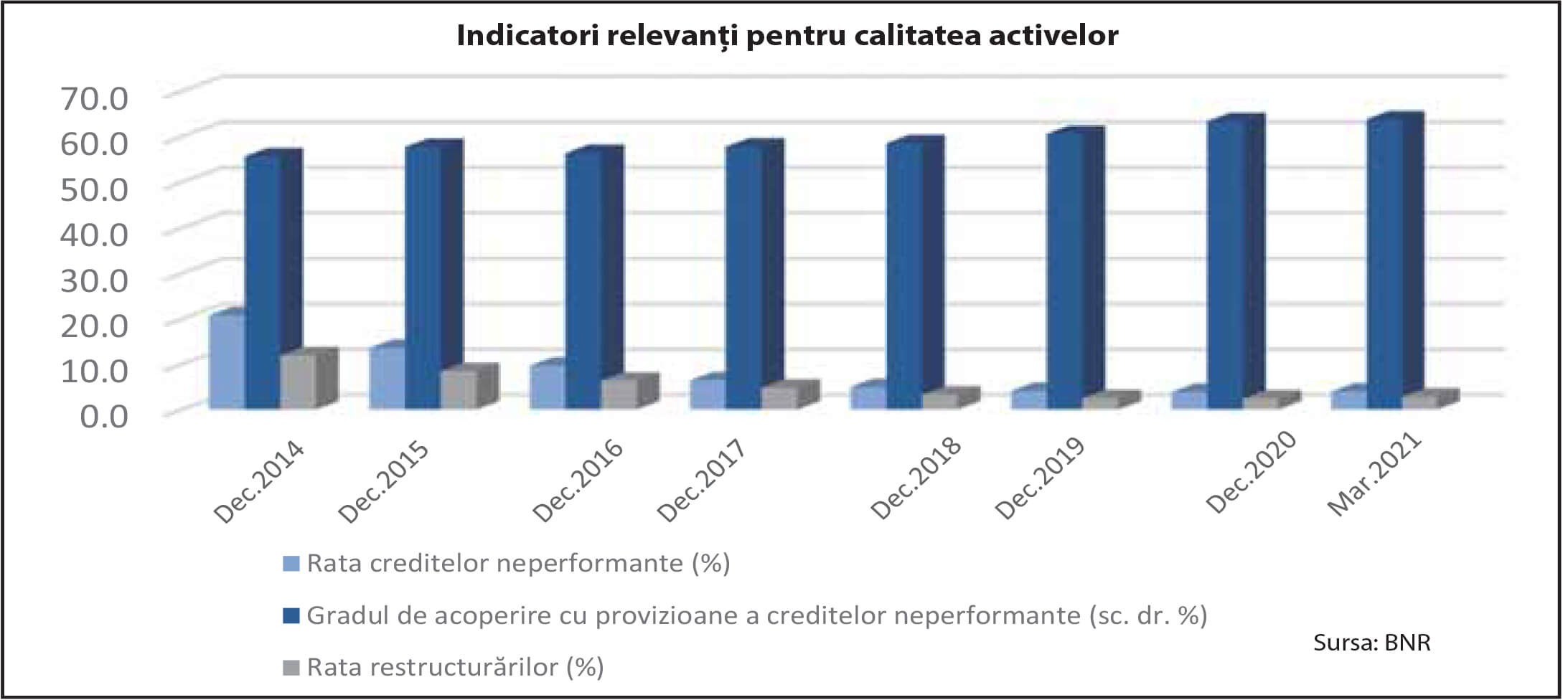

published in the NBR Report on Financial Stability. The NBR data shows that, by the end of March 2021, less than 1% of the exposures granted to corporations and to households benefited from the moratoria. The development of the NPL ratio depends on the recovery pace of Romania’s economy – taking into account the healthcare crisis – and on the financial redress capacity of the debtors who resorted to public and private moratoria. The non-performance of the companies which benefited from the suspending of their loan payment obligations stood at 12.3% in March 2021 compared to 5.2% for the companies that did not resort to moratoria, while as regards households, these values stood at 7.4% respectively 3.1%, mentions the NBR Report on Financial Stability 2021. The manufacturing industry, real estate business and wholesale and retail trade are the main sectors that made use of the moratoria. Romania had one of the highest speeds in cutting the NPL ratio among European countries, the drop happening almost 6 times in 7 years, to 3.91% in May 2021. The default risk on the loans granted to the non-government sector represents high systemic risk while the risk of access to financing the real economy is a moderate systemic risk, mentions the NBR Report on Financial Stability 2021. The tensions in macroeconomic balances, including following the effects of the COVID-19 pandemic, represent severe systemic risk. During the first half of last year, the default risk on the loans contracted by the non-government sector was considered as moderate systemic risk, but on the rise if we examine the Map of the risks to financial stability in Romania. Once the moratorium on suspending the loan payment obligations expires for the debtors who have already accessed this facility for a period of maximum nine months, we could witness the default of some customers on their bank loans payments and, implicitly, the going up of the NPLs across the banking sector. In conformity with the results of the stress test exercise deployed by the NBR in the banking sector at the end of 2020: in the basic scenario, the NPL ratio would reach 9.2% in December 2021, respectively 9.9% in December 2022 (the exercise’s assumptions took into account the balance sheet cleaning and the taking out of some items off -balance sheet), a situation which would bring about a repositioning of the high risk indicator, in conformity with the approach of the EBA, shows the annual NBR Report.

Therefore, a potential accelerated growth in the NPL ratio in the context of the pandemic and of delaying instalment reimbursement could be solved in substance, at least in the first round, by a receivables transfer with the full deductibility of losses, in order to avert affecting the solvency ratios, the capacity to lend to the economy and even financial stability. For the banks operating in Romania, receivables’ transfer – as amended by law, i.e. limiting the deductibility of the resulting losses – does not represent an option.

Limiting the deductibility of the losses resulting from transferred receivables/additional taxation of these operations has a negative impact upon the economic viability of the process of claim alienation and not only upon the banking sector, for that matter. From the banks’ point of view, the NPL portfolios’ transfer to the detriment of NPLs is discouraged since, in most cases, the receivables’ transfer takes place after the loans become overdue, moment when the value of the claim becomes certain and demandable. For the amount of money collected, tax is paid in conformity with the Fiscal Code. The banking community requests support for the elimination of the limit on the deductibility of the losses resulting from transferred receivables/additional taxation of these operations. The banking sector has to stay agile in order to continue lending to Romania’s economy. Moreover, with a view to prevent the generating of a new wave of NPLs, we need to take into account adapting the national legal framework to the European Action Plan published in December 2020, contemplating the four goals of the plan, as follows:

- Continuing to develop secondary markets for troubled assets, an action which will allow banks to take the NPLs out of their balance sheets while, at the same time, continuing to assure debtors consolidated protection;

- The reform of the EU legislation in the insolvency and debt recovery matters which will contribute to the convergence of the different EU insolvency frameworks, while maintaining high protection standards for customers;

- Support for the setting up and cooperation of the national asset management companies at EU level;

- Enforcing public support preventive measures, where necessary, in order to provide for the continuation of financing the real economy – as set forth in the EU Directive on the recovery and resolution of banking institutions and state aid frameworks.

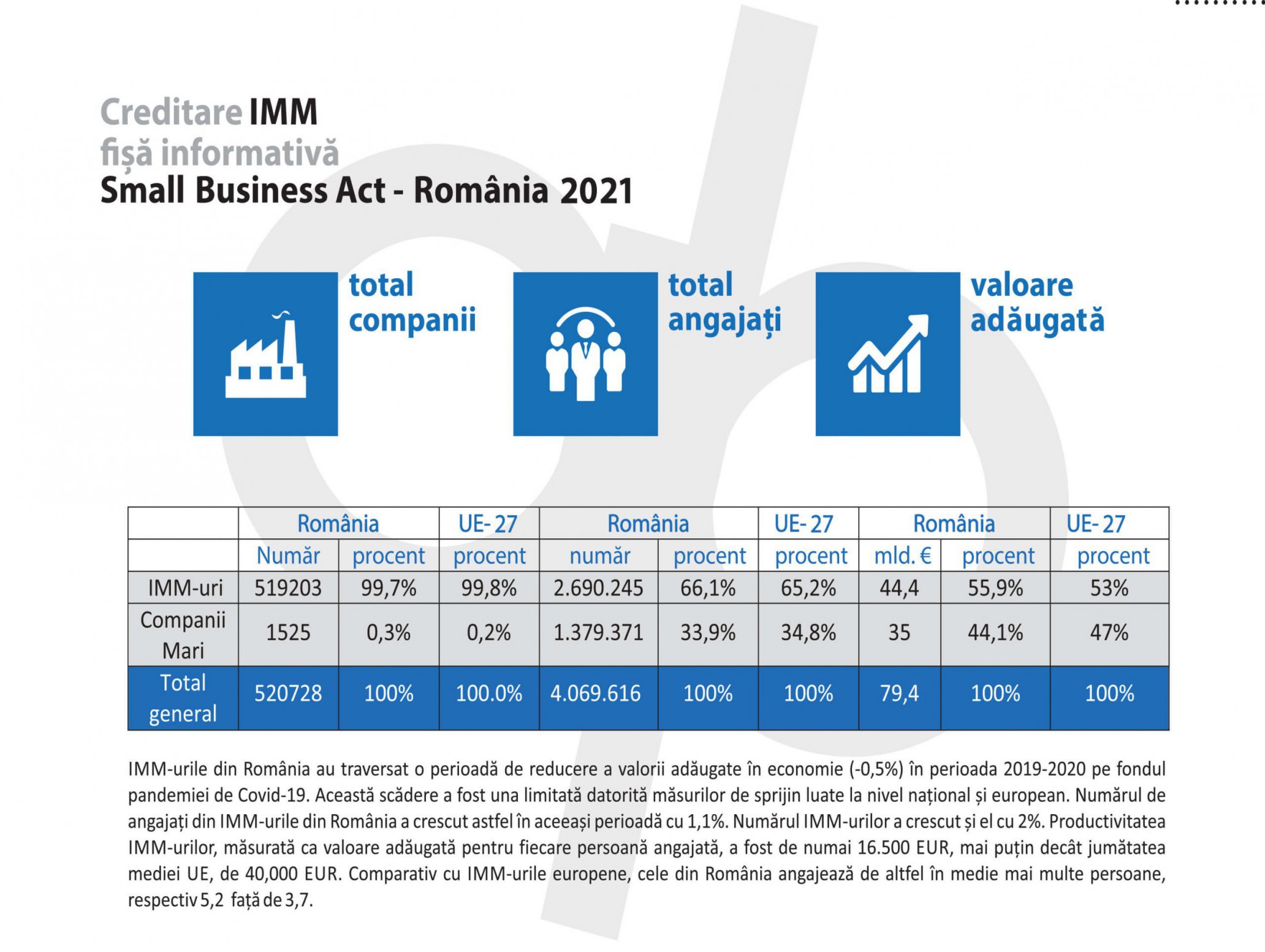

Insolvent companies have a weight of 3% in the loan stock but they are accountable for 30% of non-performing exposures, according to the NBR. The data published by the NBR in the Report on Financial Stability shows the fact that, at the end of 2019, the number of companies with own funds under the regulated limit stood at 244.1 k, down by 5.9% compared to the previous year, representing 35.4% of the total number of non-financial companies.

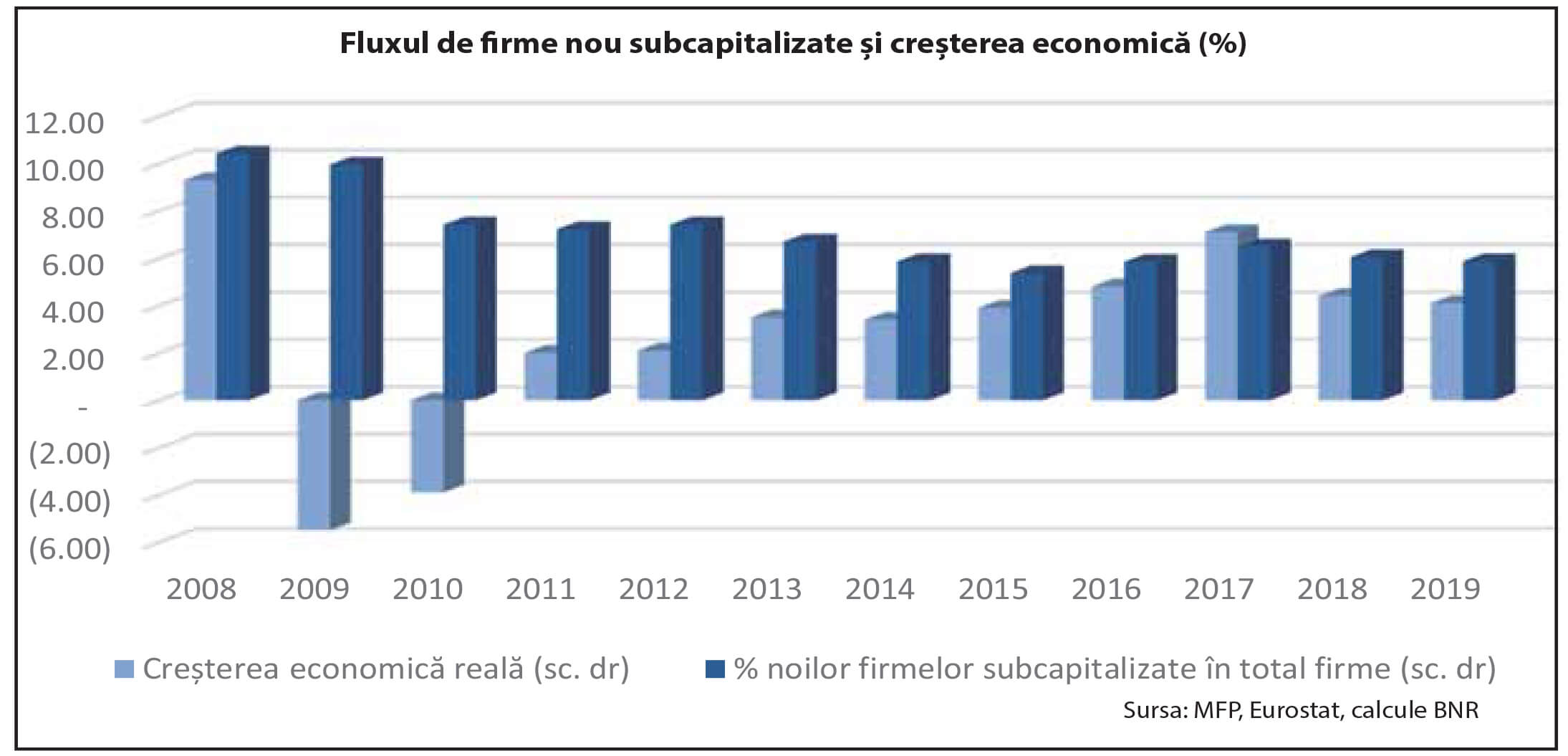

Of these, 97% had negative own funds. In order to reach the regulated level of own funds, the capitalization needed by the companies in this category amounts to 154.6 billion lei. 30% of these firms have been in this situation for at least 10 years and 14.2% of them have continued being undercapitalized year after year, starting with 2008. The average duration for companies to stay undercapitalized is about 7 years. To a great extent, companies use trade credit amounting to 30% of their liabilities, according to the data published in the Report on Financial Stability in June 2021.

With a strategy aiming to enhance financial intermediation, on long-term, Romania could catch up on the gaps in fi nancial intermediation compared to the states in the region. The unpredictable legal framework, a low level of financial education and a low level of economic welfare are the factors which could delay the taking of the road adequate to double the GDP/capita at national level.

Last year, the National Bank of Romania and the Romanian Association of Banks set up a Task Force having as aim to enhance financial intermediation on sustainable basis. The National Bank of Romania has publicly launched an invitation to all interested stakeholders to join this Task Force, the barriers belonging to the regulatory field and, particularly, to the legal one. The relationship between the financial sector and economic growth was analysed in many specialised surveys, conducted during many years. Starting from the analysis of 80 countries for a duration of 30 years, these surveys have demonstrated the fact that financial intermediation creates the premises needed for future economic growth. Thus, they have demonstrated that the level of development and of financial intermediation are strongly associated with the real GDP/capita growth, with rates of physical capital accumulation and with efficiency improvement as regards the manner in which economies use capital. In Romania, the dimension of financial intermediation i.e. 26.8% leaves enough room to boost lending, respectively the current bank financing of the economy in a balanced manner, without generating potential contingent liabilities like those already present to a certain extent in the euro area Member countries, a region much more dependent on the banking sector for funding. If financial intermediation increases to 40% – the maximum level reached in 2010 – the estimates are a potential surplus of 167 billion lei, with an annual average of 33.4 billion lei. Committing to a pro-active policy to boost lending and to increasing the number of people who use bank products and services leads, in time, to enhancing the Romanians’ economic welfare. We are of the opinion that it is in the best interest of the authorities to adopt measures leading to reducing social disparities, in order to increase economic welfare, reduce migration and improve demographics. We think that these measures are necessary in order to assure a level playing field for all on the domestic market, so that all economic players benefit from uniform regulations and similar profitability conditions, while maintaining payment discipline. The banking sector is prepared both as a whole – via the Romanian Association of Banks – and at individual level – via banking institutions – to contribute to accelerating the process of accessing European funds and the funds made available via the National Recovery and Resilience Plan (PNRR). The banking community of Romania is available to support the Romanian authorities in the process of implementing the National Recovery and Resilience Plan, and to support the underlying projects via specific financing instruments. We would like to contribute also to identifying the best support types needed by the market and the ways to implement them by partners, such as the implementation of capped/not capped guaranteeing instruments or risk-sharing financing which could be very quickly implemented by banks, as there is enough expertise in the banking sector to enforce them.

The banking sector of Romania is prepared from the point of view of the solvency and liquidity ratios to support an alert and sustainable pace of lending. In Romania, the loan-to-deposit ratio for households and for non-financial institutions stood at 68.15% in June 2021, while the EU average was 111%, a fact which demonstrates the high potential that banks in Romania have to boost lending. The NBR data shows that the ratio to cover liquidity needs increased to 279% in March 2021, taking into account that the EU average was 173.7%.